Overview of market demand for lead-acid batteries

As chemical power source with the longest history of use, lead-acid batteries enjoy enduring popularity and are widely used in backup power batteries e.g. telecommunications, power systems, computer systems and automation control systems, and emergency lighting, starter battery fields e.g. new energy and energy storage batteries, automobiles, ships, motorcycle, tank, tractor, and diesel engine, and power battery fields including electric bicycles, electric vehicles, electric tricycles, electric forklifts and golf carts.

A. UPS battery requirements

UPS power supply is the abbreviation of Uninterruptable Power Supply. As an electronic AC conversion system with energy storage device, its basic function is to provide uninterrupted power supply when power is interrupted, and always provide high quality AC power supply to the load, achieves voltage stabilization and frequency stabilization, suppresses interference from surges, spikes, electrical noise, compensation voltage sag, and long-term low voltage. UPS power systems can be divided into two major categories according to their application areas: UPS power systems for information equipment and UPS power systems for industrial power. The UPS power system for information equipment is mainly used in the security protection of computer information systems, communication systems and data network centers in information industry, IT industry, transportation, financial industry, and aerospace industry. It is used as important peripherals e.g. computer information systems, communication systems, and data network center, and plays important role in protecting computer data, ensuring the stability of voltage and frequency of power grid, improving the quality of power grid, and preventing damage to users caused by instantaneous power outages and accident power outages. The UPS power system for industrial power is mainly used in industrial power equipment industry power, steel, non-ferrous metals, coal, petrochemicals, construction, medicine, automobiles, food, and military fields, and used as AC and DC uninterruptible power supply equipment of power automation industrial system equipment and remote execution system equipment, opening and closing of high-voltage circuit breakers, relay protection, automatic devices, and signaling devices. Quality directly matters the safe operation of power grid and the UPS power system is the "heart" of power generation equipment and transmission and transformation equipment. The market size of UPS in China is expected to be 5.519 billion yuan in 2016, and the market will maintain a rapid growth rate in the future.

China's UPS Market Size, 2010~2016 (RMB 100 Million)

B. Demand for communication power batteries

Lead-acid batteries are mainly used as backup power supply of mobile base stations in telecommunications industry, and are used for backup power supply and energy storage power supplies for control protection and power DC power supply systems of power plants and substations in the power industry. The product category is valve-regulated sealed maintenance-free stationary lead-acid battery. Therefore, the market demand for lead-acid batteries for communication power is inseparable from the development prospects and investment intensity of the communication power industry. The communications industry is currently one of the fastest growing and most innovative and creative areas. During the "13th Five-Year Plan" period, the State will continue to strengthen the construction of "Broadband China" and promote the construction of basic telecommunication networks. Accelerate the construction of all-fiber network cities and 4G networks. In 2015, the investment in network construction exceeded 430 billion yuan, and cumulative investment in the years 2016~2017 was not less than 700 billion yuan. Promote the optical fiber-to-the-home process, expand mobile communication coverage, and increase the mobile broadband speed. The domestic telecommunications industry's demand for valve-regulated sealed lead-acid batteries will grow steadily. In addition, standby power supplies for power system substations, rechargeable lighting fixtures, rechargeable fans and other electrical emergency electrical products also have strong demand for lead-acid batteries.

C. Market demand for energy storage battery

Lead-acid batteries for energy storage refer to lead-acid batteries for energy storage that are suitable for new energy power generation equipment powered by solar energy and wind energy. The development of new energy (wind energy, solar energy, etc.) has been strongly supported by government departments for its two-way positives for promoting sustainable development and new economic growth points, and is also the development focus in the future. Energy storage battery technology is one of the key technologies restricting development of the current new energy storage industry. Energy storage technology has wide range of applications and huge market demand potential, and is a key link in the interconnection of energy, mainly reflected in the following aspects: Firstly, the output power of intermittent power sources e.g. photovoltaics and wind power is unstable. When its proportion in power generation reaches rather high, certain impact will be caused to the power grid, so certain proportion of energy storage is needed to stabilize the output power of photovoltaic and wind power stations. Secondly, in areas where electricity prices are relatively high compared to on-grid electricity prices, and in areas where peak and valley electricity prices vary widely, distributed energy storage is often easy to be economic; microgrid and off-grid demand is also very direct for energy storage. Thirdly, the application of energy storage in the power system will change the mode of synchronous completion of power production, transmission and use, and make up for the lack of "storage and release" functions in the power system to achieve the purpose of optimizing the allocation of power resources and improving energy efficiency. Fourthly, advances in energy storage technology have also driven the rapid development of electric vehicles. Fifthly, in the emerging interconnection of energy, energy storage technology will be critical to coordinating these applications due to the large quantity of renewable energy and distributed energy access in large power grids, combined with the popularized application of microgrids and electric vehicles. As part of this, the energy storage link will become a key node of the entire interconnection of energy; the rise of the interconnection of energy will significantly drive the demand for energy storage and help the energy storage industry achieve leapfrog development. Lead-acid battery is currently the preferential choice for energy storage batteries. From the perspective of cost, lead-acid batteries have better cost benefits compared with other chemical energy storage methods such as lithium batteries. From the perspective of product performance, lead-acid batteries have mature technology, high safety, and wide applicable temperature range. Lithium batteries have problems such as consistency in the application of large battery packs, and safety issues in large power battery cells. The new product lead-carbon battery of lead-acid batteries has further improved the battery performance, greatly increased the number of cycles, and lowered the unit times cost of use. Lead-acid battery products have relatively promising prospects of application in the field of energy storage.

According to the forecast of the International Energy Agency, global energy demand will increase by one-third from 2011 to 2035, and the proportion of renewable energy will increase from the current 13% to 18% by 2035. The grid-connected application of new energy e.g. wind power and solar energy and distributed grid applications will offer vast market space for energy storage batteries. The Energy Development Strategy Action Plan (2014~2020) by the State Council raised the adjustment of the energy structure to the level of national strategy. By 2020, non-petrochemical energy will account for 15% of primary energy consumption and the coal consumption will be controlled within 62%. The plan calls for vigorous development of wind power. The installed capacity of wind power will increase from 145 million kilowatts in 2015 to 200 million kilowatts in 2020, with an average annual growth rate of 6.64%. The growth of solar power will be accelerated, and the installed photovoltaic capacity will increase from 43.18 million kilowatts in 2015 to 100 million kilowatts in 2020, with average annual growth rate of 18.19%. The rapid development of new energy sources e.g. solar energy and wind energy in the world and in China generates greater demand for high-performance energy storage batteries.

D. Demand for starter battery

起The starter battery mainly provides energy for the starter motor of auto or motorcycle equipped with internal combustion engine, thereby driving the rotation of engine flywheel to realize the start of the engine, and also supplies power for lighting. The starter battery is required to supply large current in a short period of time, and can work normally even at low temperatures below minus 20 degrees. At the same time, it has good resistance to overcharge when continuously charge the battery after the internal combustion engine starts. Lead-acid batteries precisely meet the needs in this field with its advantages such as wide range of applicable temperature difference, excellent high-current discharge performance, safety and stability, and high cost performance. In terms of capacity, price, safety, and environmental applicability, other batteries have certain gap with lead-acid batteries, and cannot form substantial competition with lead-acid batteries in the field of starter batteries. The starter battery market mainly includes the automobile starter market and the motorcycle starter market.

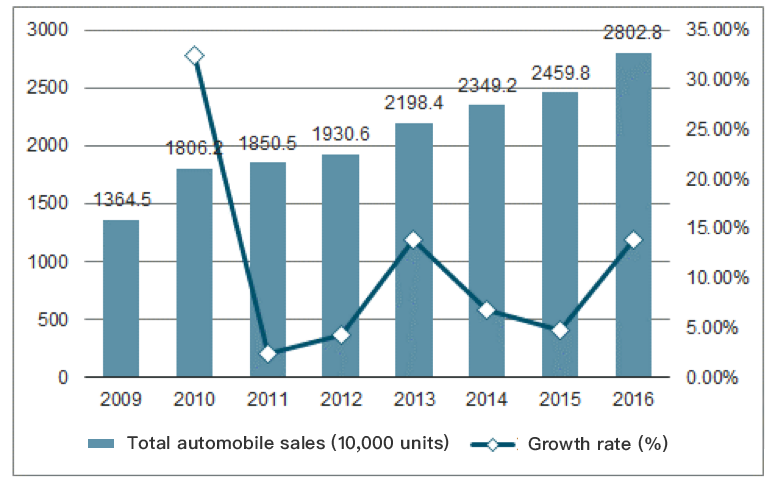

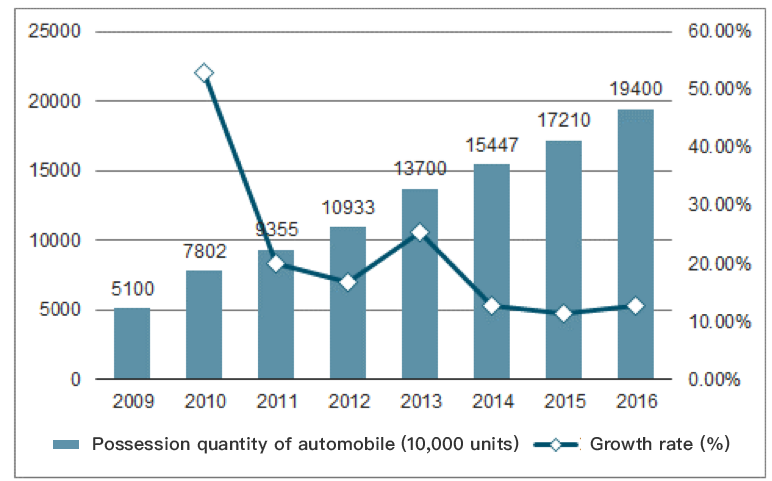

The downstream market of automobile starter battery is classified into primary market (supporting market) and secondary market (maintenance market). Under the background of continuous growth in automobile production and sales and the number of automobiles, the size of automobile starter battery market has shown rapid growth. The primary market is to provide supporting supplies for automobile manufacturers, and each new automobile is normally equipped with one battery. The secondary market refers to the customers of existing vehicles who purchase batteries through dealers such as auto parts dealers, auto 4S stores, battery operation departments, and auto repair shops during vehicle maintenance and repair. Automobile starter batteries are consumables in auto parts, with average life of about 2 years. Therefore, the market demand for automobile starter batteries is the sum of the sales of new automobiles and half the possession quantity of automobiles. China's auto sales increased from 18.062 million in 2010 to 28.028 million in 2016, with an average annual growth rate of 7.60%; China's automobile ownership increased from 78.02 million in 2010 to 194 million in 2016, an average annual growth up to 16.39%. The continuously increasing sales and stock of automobiles have provided favorable market environment for the development of automobile starter batteries.

China's total automobile sales, 2009~2016 (10,000 units)

China's possession quantity of automobile (2009~2016) (10,000 units)

E. Demand for power battery

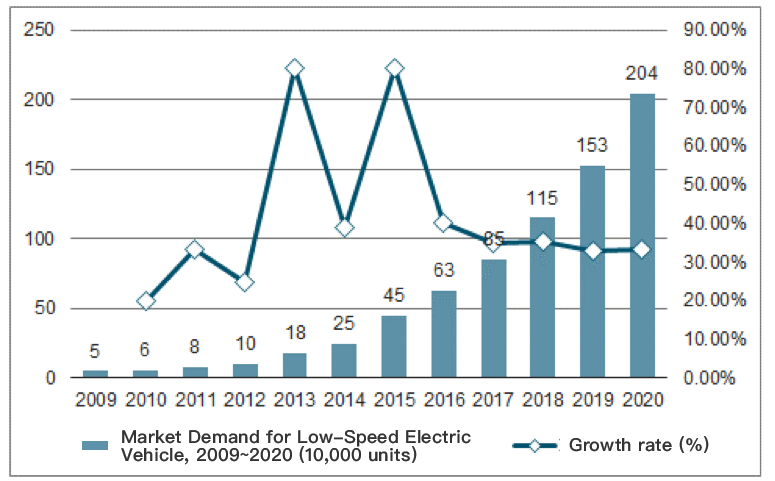

Power batteries are required with high-power charging and discharging performances. They are mainly used in electric bicycles, electric tricycles, and low-speed electric vehicles. The market demand is in the trend of steady growth. The power battery market is divided into primary market and secondary market, of which the primary market is the new auto market and the secondary market is the maintenance market. Currently, the replacement cycle of lead-acid battery is about 2 years. The sales volume of lead-acid batteries for electric bicycles in the Chinese market will grow steadily at a compound annual growth rate of 5.4% from 2016 to 2021. Electric tricycles have the dual functions of travelling and cargo loading, and are very popular in rural areas and second- and third-tier cities. The last mile of the flourishing express delivery industry is basically completed by electric tricycles. On October 26, 2015, the State Council of China issued Several Opinions on Promoting Development of the Express Delivery Industry. According to the Opinion, China will basically reach the objective of town-to-town outlets and village-to-village express delivery in 2020, with annual express delivery volume of 50 billion pieces. National standards for electric tricycles for express delivery, as well as production, use, and management regulations will be worked out. The rapid development of China's express delivery industry and the acceleration of urbanization are bound to promote the explosive growth of the electric tricycle market. China sold 15 million electric tricycles in 2015, representing year-on-year increase of about 30%. It is estimated that by 2020, the ownership of China's electric tricycles will have been close to 100 million. With the healthy development of industry standardization, lead-acid batteries for low-speed electric vehicles have become new growth point. Low-speed electric vehicles currently using lead-acid batteries are mainly concentrated in provinces such as Shandong and Henan. Since 2014, local industry regulations have been released successively, and industry normalization has seen improvement. For example, Shandong Province issued the Shandong Provincial Industry Standard on Automotive (Small Pure Electric Vehicles) on June 12, 2014, and Shandong Access Conditions for Enterprises producing Small Electric Vehicle; Luoyang City, Henan Province, released the Interim Measures for Production and Management of Low-speed Four-wheel Electric Vehicles in March 2014. In 2015, Shandong Province produced 347,000 small electric vehicles, representing a year-on-year increase of about 53.7%, and its output grew by more than 50% for three consecutive years. Shandong Province proposed the planned objective of producing 1 million mini-electric vehicles per year by 2020.

China's Market Demand for Low-Speed Electric Vehicle, 2009~2020 (10,000 units)

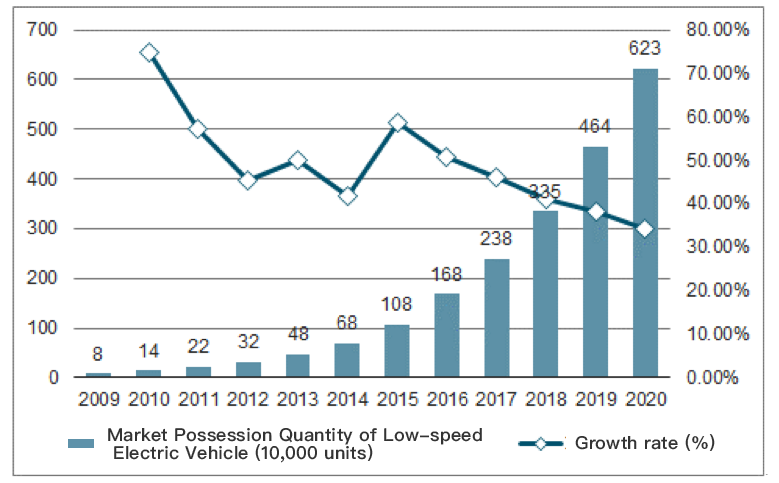

China's Market Possession Quantity of Low-speed Electric Vehicle, 2009~2020 (10,000 units)

-

About Tysen-Kld

-

PRODUCT

-

APPLICATIONS

-

SERVICE

-

INDUSTRY

-

JOB

-

Copyright: TYSEN-KLD(Beijing) Power Technology Co., Ltd.  Beijing public network security No.11010502040103Edition Beijing ICP No.20004525

Beijing public network security No.11010502040103Edition Beijing ICP No.20004525

Address: Room 606-608, Sixth Floor, No. 651 Yunling East Road, Putuo District, Shanghai Phone: 021-6288-6915